Unlocking The Secrets Of Wealth

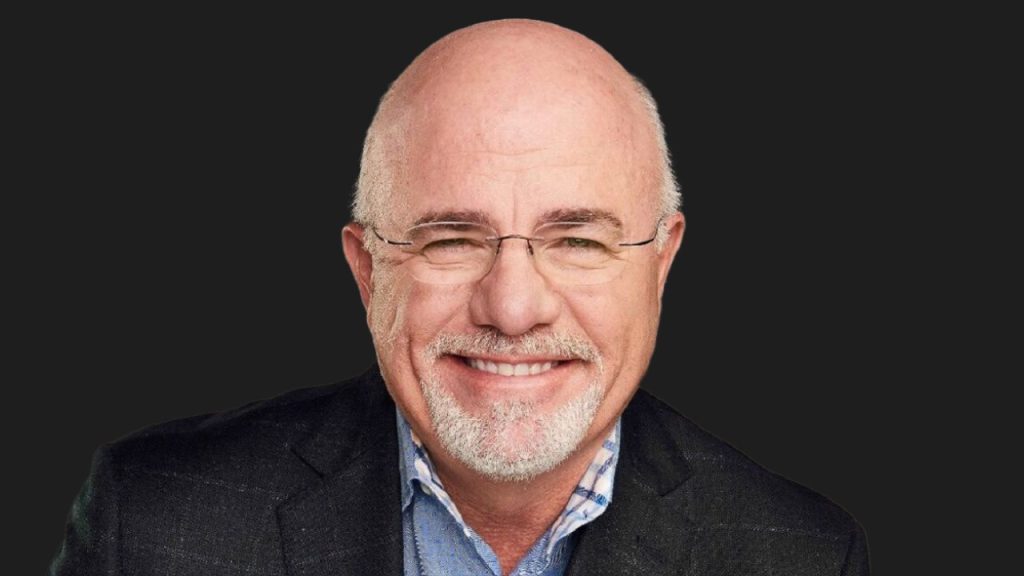

Dave Ramsey Net Worth 2 is the numerical value of the assets held by Dave Ramsey, a financial advisor and radio show host. For instance, in 2021, his net worth was estimated to be around $60 million.

Understanding Dave Ramsey's net worth is relevant because it highlights his financial success and can provide insights into the effectiveness of his financial advice. Additionally, it serves as a benchmark for others to gauge their progress.

Ramsey's net worth has steadily increased over the years due to his successful financial advising business and media ventures. This growth demonstrates his ability to generate income and build wealth.

Dave Ramsey Net Worth 2

Understanding the essential aspects of Dave Ramsey's net worth is crucial for gaining insights into his financial success and the effectiveness of his financial advice.

- Income: Ramsey earns revenue from his financial advising business, book sales, and media ventures.

- Assets: His assets include investments, real estate, and cash.

- Liabilities: Ramsey's liabilities may include mortgages, loans, and business expenses.

- Growth: His net worth has grown steadily over the years due to successful ventures.

- Diversification: Ramsey's wealth is diversified across various asset classes to mitigate risk.

- Debt Management: Ramsey advocates for debt reduction and financial responsibility.

- Retirement Planning: He emphasizes the importance of saving and investing for retirement.

- Estate Planning: Ramsey's net worth will likely be distributed through estate planning strategies.

- Financial Education: His advice and resources focus on educating individuals about personal finance.

Dave Ramsey's net worth is a reflection of his financial acumen and the success of his financial advising principles. By examining these aspects, we can gain valuable insights into wealth management, debt reduction, and financial independence.

Income: Ramsey earns revenue from his financial advising business, book sales, and media ventures.

Dave Ramsey's substantial net worth is largely attributed to his diverse income streams. One key aspect of his income generation is his financial advising business, Ramsey Solutions, which provides financial guidance and educational resources.

- Financial Advising: Ramsey generates revenue through his financial advising services, including personalized consultations, seminars, and online courses. His expertise in debt management and personal finance has attracted a large clientele.

- Book Sales: Ramsey has authored several bestselling books on personal finance, such as "The Total Money Makeover" and "Financial Peace." Royalties from these publications contribute significantly to his income.

- Media Ventures: Ramsey hosts a popular radio show, "The Dave Ramsey Show," and has made numerous television appearances. These media ventures generate advertising revenue and boost his overall brand visibility.

Ramsey's diverse income streams have allowed him to build a substantial net worth. His success highlights the importance of developing multiple revenue sources and leveraging expertise in a particular field.

Assets: His assets include investments, real estate, and cash.

Assets play a crucial role in determining Dave Ramsey's net worth. Assets are valuable resources or properties owned by an individual or entity. In Ramsey's case, his assets primarily comprise investments, real estate, and cash. These assets contribute positively to his overall financial standing and contribute to the growth of his net worth.

Investments, such as stocks, bonds, and mutual funds, represent a significant portion of Ramsey's assets. By investing wisely and diversifying his portfolio, he generates passive income and capital appreciation, which increases his net worth. Additionally, Ramsey owns several properties, including his primary residence and investment properties. Real estate assets can provide rental income, potential capital gains, and tax benefits, further boosting his net worth.

Cash and cash equivalents, such as savings accounts and money market accounts, offer liquidity and stability to Ramsey's financial profile. Maintaining a healthy cash balance allows him to meet short-term obligations, seize investment opportunities, and withstand financial emergencies without compromising his long-term financial goals.

In summary, Dave Ramsey's net worth is directly influenced by the value and performance of his assets. By accumulating and managing his assets strategically, he has built a solid financial foundation and increased his overall wealth.

Liabilities: Ramsey's liabilities may include mortgages, loans, and business expenses.

Liabilities represent financial obligations that reduce an individual's net worth. In Dave Ramsey's case, his liabilities may include mortgages, loans, and business expenses. Understanding the relationship between liabilities and Ramsey's net worth is crucial for assessing his overall financial health.

Mortgages, loans, and business expenses can significantly impact Ramsey's net worth. Mortgages, for instance, represent a substantial liability, reducing his net worth by the outstanding loan amount. Similarly, loans and business expenses can deplete his financial resources, further decreasing his net worth.

However, it's important to note that not all liabilities are detrimental to Ramsey's net worth. For example, a mortgage can also be considered an asset if the property appreciates in value over time. Additionally, business expenses can contribute to revenue generation, potentially increasing Ramsey's net worth in the long run.

Managing liabilities effectively is essential for Ramsey to maintain a healthy net worth. By minimizing unnecessary debt, negotiating favorable loan terms, and maximizing tax deductions on business expenses, he can reduce the negative impact of liabilities on his overall financial position.

Growth: His net worth has grown steadily over the years due to successful ventures.

The growth of Dave Ramsey's net worth is directly attributed to his successful ventures. Ramsey's financial advising business, Ramsey Solutions, has played a pivotal role in his financial success. Through personalized consultations, seminars, and online courses, Ramsey has helped countless individuals manage their finances effectively, generate passive income, and achieve financial independence. The revenue generated from these services has significantly contributed to Ramsey's overall net worth.

In addition to his financial advising business, Ramsey has authored several bestselling books on personal finance, such as "The Total Money Makeover" and "Financial Peace." These publications have sold millions of copies, generating substantial royalties for Ramsey and further boosting his net worth. Ramsey's expertise and insights into personal finance have made him a sought-after speaker and media personality. His popular radio show, "The Dave Ramsey Show," and numerous television appearances provide additional income streams and enhance his brand visibility.

Ramsey's successful ventures have not only increased his net worth but also enabled him to expand his financial education empire. He has established a team of financial advisors, created online resources, and developed educational programs to help individuals achieve financial freedom. By leveraging his success, Ramsey has made a positive impact on the financial well-being of countless individuals and families.

Diversification: Ramsey's wealth is diversified across various asset classes to mitigate risk.

Dave Ramsey's net worth is not solely dependent on a single asset class or investment strategy. Instead, he has diversified his wealth across various asset classes to mitigate risk and enhance overall financial stability.

- Stocks: Ramsey invests a portion of his wealth in stocks, which represent ownership shares in publicly traded companies. Stocks have the potential for long-term growth but also carry higher risk.

- Bonds: Bonds are fixed-income securities that provide regular interest payments. They are generally considered less risky than stocks but also offer lower potential returns.

- Real Estate: Ramsey owns multiple properties, including his primary residence and rental properties. Real estate can generate passive income through rent and appreciate in value over time.

- Cash and Cash Equivalents: Ramsey maintains a healthy balance of cash and cash equivalents, such as high-yield savings accounts and money market accounts. These assets provide liquidity and stability to his portfolio.

By diversifying his wealth across these different asset classes, Ramsey reduces the overall risk associated with his investments. If one asset class underperforms, the others can potentially offset the losses, helping to preserve his net worth and financial well-being.

Debt Management: Ramsey advocates for debt reduction and financial responsibility.

Dave Ramsey's unwavering advocacy for debt reduction and financial responsibility has played a pivotal role in the growth and maintenance of his substantial net worth. Ramsey believes that eliminating debt is crucial for achieving financial freedom and building a secure financial future.

Ramsey's debt management philosophy is centered around the "debt snowball" method, which involves paying off debts from smallest to largest, regardless of interest rates. By focusing on eliminating smaller debts first, individuals can gain momentum and motivation to tackle larger ones. This approach not only reduces the overall interest paid but also improves credit scores and frees up cash flow for savings and investments.

Real-life examples abound of individuals who have transformed their financial situations by following Ramsey's debt management principles. Many have successfully paid off thousands of dollars in debt, improved their creditworthiness, and increased their net worth. Ramsey's approach has empowered countless people to take control of their finances and achieve their financial goals.

Understanding the connection between Ramsey's debt management advocacy and his net worth is crucial for anyone seeking to improve their financial well-being. By prioritizing debt reduction and practicing financial responsibility, individuals can lay the foundation for long-term wealth creation and financial freedom.

Retirement Planning: He emphasizes the importance of saving and investing for retirement.

Retirement planning is an integral aspect of Dave Ramsey's net worth. Ramsey strongly advocates for saving and investing early and consistently for retirement to secure financial stability in later years. His belief stems from the understanding that retirement can be a significant expense, and individuals need to accumulate sufficient funds to maintain their desired lifestyle without relying heavily on external sources.

Ramsey's retirement planning strategies have played a crucial role in his overall net worth. By prioritizing retirement savings, he has been able to build a substantial nest egg that provides him with financial freedom and peace of mind. Real-life examples abound of individuals who have followed Ramsey's advice and successfully retired early or achieved financial independence through diligent saving and investing.

Understanding the connection between retirement planning and Ramsey's net worth is essential for anyone seeking to secure their financial future. By incorporating these principles into their own financial plans, individuals can potentially increase their net worth, reduce financial stress, and enjoy a more comfortable retirement.

Estate Planning: Ramsey's net worth will likely be distributed through estate planning strategies.

Estate planning plays a significant role in managing and distributing Dave Ramsey's net worth after his passing. Through carefully crafted strategies, he can ensure that his assets are distributed according to his wishes, minimizing tax burdens, and supporting his loved ones' financial well-being.

- Wills and Trusts: Wills and trusts are legal documents that outline the distribution of assets and appoint individuals to manage the estate. They provide clear instructions on how Ramsey's wealth should be distributed, reducing the risk of disputes and ensuring his intentions are carried out.

- Tax Mitigation: Estate planning strategies can be used to minimize inheritance taxes and estate taxes, preserving Ramsey's wealth for his beneficiaries. By utilizing trusts, charitable donations, and other tax-saving techniques, he can reduce the financial burden on his heirs.

- Legacy Planning: Estate planning allows Ramsey to create a legacy that extends beyond his lifetime. Through the establishment of charitable trusts or foundations, he can support causes close to his heart and make a lasting impact on society.

- Beneficiary Designations: Ramsey can designate specific beneficiaries for his retirement accounts, life insurance policies, and other assets. This ensures that these assets pass directly to his intended beneficiaries, avoiding probate and ensuring their timely distribution.

By implementing comprehensive estate planning strategies, Dave Ramsey can safeguard his net worth, provide for his family, minimize tax liabilities, and create a lasting legacy that reflects his values and wishes.

Financial Education: His advice and resources focus on educating individuals about personal finance.

Financial education plays a crucial role in Dave Ramsey's net worth growth and management. His advice and resources empower individuals to make informed financial decisions, leading to increased wealth accumulation and financial well-being.

- Budgeting and Expense Tracking: Ramsey emphasizes the importance of creating and adhering to a budget, tracking expenses to identify areas for savings and debt reduction.

- Debt Management: He educates on effective debt management strategies, including the "debt snowball" method, to help individuals eliminate debt and improve their credit scores.

- Investment Principles: Ramsey provides guidance on investment basics, helping individuals build a diversified portfolio and maximize long-term returns.

- Retirement Planning: He stresses the significance of saving and investing for retirement early on, providing strategies for maximizing retirement income and securing financial independence.

By educating individuals about personal finance and empowering them to manage their finances effectively, Dave Ramsey's advice and resources contribute significantly to the growth and preservation of his net worth. His financial education initiatives have positively impacted countless lives, fostering financial literacy and promoting responsible financial habits.

Frequently Asked Questions

The following FAQs address common inquiries and clarify various aspects of Dave Ramsey's net worth:

Question 1: How did Dave Ramsey accumulate his wealth?

Ramsey's fortune primarily stems from his successful financial advising business, book sales, and media ventures. His expertise in debt management and personal finance has attracted a large clientele and generated substantial revenue.

Question 2: What types of assets contribute to Dave Ramsey's net worth?

Ramsey's assets include investments in stocks, bonds, and real estate. He also holds cash and cash equivalents for liquidity and stability.

Question 3: How does Dave Ramsey manage his liabilities?

Ramsey prioritizes debt reduction and advocates for the "debt snowball" method. He minimizes unnecessary debt and negotiates favorable loan terms to reduce the impact of liabilities on his net worth.

Question 4: What is Dave Ramsey's approach to retirement planning?

Ramsey emphasizes the importance of saving and investing for retirement early on. He recommends a diversified portfolio and maximizing retirement income sources to ensure financial security in later years.

Question 5: How does Dave Ramsey's financial education contribute to his net worth?

Ramsey's financial education initiatives empower individuals to make informed financial decisions. By teaching budgeting, debt management, and investment principles, he indirectly contributes to the growth and preservation of his own net worth.

Question 6: What is the significance of estate planning for Dave Ramsey's net worth?

Estate planning strategies, such as wills and trusts, allow Ramsey to distribute his assets according to his wishes, minimize tax burdens, and create a lasting legacy that aligns with his values.

These FAQs provide valuable insights into the factors that have contributed to Dave Ramsey's substantial net worth. Understanding these aspects can help individuals develop effective financial strategies and work towards their own financial goals.

To further explore Dave Ramsey's financial advice and strategies, please proceed to the next section.

Dave Ramsey's Financial Tips

This section provides actionable tips inspired by Dave Ramsey's financial philosophy, empowering you to take control of your finances and build wealth.

Tip 1: Create a Budget: Track your income and expenses meticulously to identify areas for saving and debt reduction.

Tip 2: Prioritize Debt Payoff: Use the "debt snowball" method to eliminate debt from smallest to largest, regardless of interest rates.

Tip 3: Build an Emergency Fund: Save 3-6 months' worth of expenses in a liquid account for unexpected events.

Tip 4: Invest for the Long Term: Diversify your portfolio with a mix of stocks, bonds, and real estate to maximize returns.

Tip 5: Live Below Your Means: Avoid unnecessary spending and focus on accumulating wealth gradually.

Tip 6: Seek Financial Advice: Consult with a qualified financial advisor if needed, especially for complex financial situations.

Tip 7: Educate Yourself: Continuously expand your financial knowledge through books, seminars, and online resources.

Following these tips can significantly improve your financial well-being, reduce debt, increase savings, and set you on the path to financial independence.

In the final section of this article, we will explore additional strategies for achieving financial success and building lasting wealth.

Conclusion

This in-depth exploration of Dave Ramsey's net worth has illuminated the multifaceted strategies that have contributed to his financial success. Key insights include the significance of income diversification, asset accumulation, and effective debt management.

Ramsey's financial empire, built on his expertise in debt reduction and personal finance, has played a pivotal role in his wealth creation. By prioritizing retirement planning, estate planning, and financial education, he has ensured the preservation and growth of his net worth.

The lessons gleaned from Ramsey's financial journey serve as valuable guidance for anyone seeking to achieve financial stability and build lasting wealth. Embracing responsible financial habits, investing wisely, and planning for the future can empower individuals to take control of their finances and secure their financial well-being.

John Rich Net Worth: Strategies For Financial Success In The HFWIEVD Niche

How Tim Matheson Built His $15 Million Net Worth

How Andy Richter Built His $12 Million Net Worth

Dave Ramsey Audio Books, Best Sellers, Author Bio

Dave Ramsey Ken and Barbie, Net Worth & Memes Crushing REI

Dave Ramsey Net Worth 2023 (FORBES) Net Worth Club 2023

ncG1vNJzZmilqam%2FqriNrGpnraNixKa%2F02ZpZ5mdlsewusCwqmebn6J8pa3VnmSrmZ2osrp5zZ6rZq%2Bfp8GpeZFnn62lnA%3D%3D